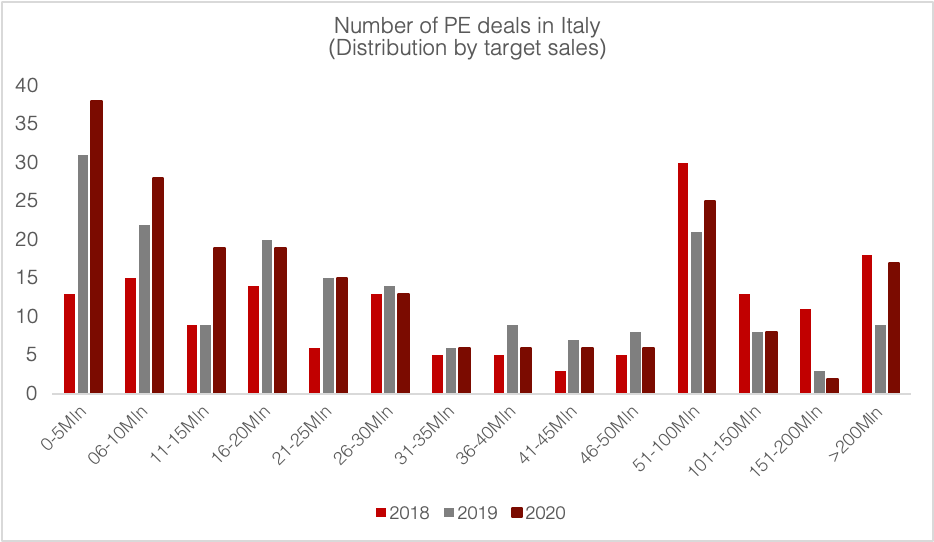

In KPMG’s April 2021 insight of the M&A Italian market[1], one of the main four trends identified is the drastic increase of SMEs-related deals during the last ten years.

Especially during 2018 – 2020, Italian deals that included target companies with less than €5 million revenues have more than tripled. Naturally, the deals’ values are very small; nevertheless, these transactions amounted to 8% of the total during 2018 and in 2020 they soared to 18%.

It is worth remembering that an important factor which led to such a growth, is the decrease in the number of mega-deals starting from 2018. In fact, uncertainties such as China – US trade war, Brexit, signs of slight economic decline and the outbreak of Covid during 2020, are reducing big corporation’s willingness to carry out M&A operations.

Italy’s economic framework has always been remarkably fragmented. In fact, 20% of all Italian limited companies are SMEs, 80% of which have less than €5M in revenues. Furthermore, SMEs employ a total of 4.2 million people across the country.

Most of the Italian SMEs are long lasting family-owned companies and in most cases, management is carried out by the family itself.

Usually, Italian SMEs perceived growth by M&A as a potential threat to the family’s single ownership: traditionally, third party access to share capital was granted during crises or generational shifts only.

However, during the last ten years Italian entrepreneurs are starting to realize that size is an asset for competitiveness and M&A operations can help to boost growth capacity, therefore financial and industrial partners are becoming players of increasing importance to succeed in international competition[2].

In fact, during these years, small companies have carried out M&A deals mainly aimed at attacking new markets, through horizontal integration (i.e., merging with companies operating in the same business), as well as to diversify their business model, thus reducing the risks of contraction in demand in their reference sector.[3]

On the other hand, medium-sized companies have focused their M&A activity on foreign operations.[4]

Our investment philosophy has been aimed at SMEs since the inception of MPD SME Capital One (MSCO).

Among the many successes achieved this year, we had the great opportunity to witness the SMEs world first-hand. In fact, thanks to the acquisition of Turin based Sell-Plast, we got to know personally all the stakeholders and the challenges an SME is facing every day.

At the time of the acquisition, Sell-Plast had roughly €2M in revenues and from its founding in the seventies onwards, it has virtually always been owned and managed by the same family. This meant that the stakeholders weren’t accustomed to dealing with a financial partner like MPD Partners. From the first interaction with the sell-side advisor until today, our main goal has been obtaining the trust of employees, management team, and the former entrepreneur.

For us, achieving such a goal not only meant a great success, but it enabled to unlock the full potential of a tremendous team, that is now working very well together with a common, long-term objective.

We’re thrilled to be part of such an adventure and by helping to overcome the daily challenges an SME is facing we know we’re doing our part in the shift towards a more friendly vision of M&A as a growth strategy.

To conclude, we are delighted to see that the market has started moving in the direction we had envisioned since the beginning, and we firmly believe that most of the opportunities are yet to come.

[1] https://home.kpmg/it/it/home/insights/2021/04/mercato-mergers-acquisitions-italiano-trend-previsioni-2021.html

[2] https://home.kpmg/it/it/home/media/press-releases/2019/10/le-pmi-dominano-mercato-fusioni-acquisizioni-italia.html

[3] https://www2.deloitte.com/content/dam/Deloitte/it/Documents/strategy/Bisogni_PMI_post_covid19_MonitorDeloitte.pdf

[4] https://www.unicattfinancialanalysts.com/post/trend-mercato-m-a-in-italia-dal-2010-al-2019-kpmg