Letter from MPD Partners to its Stakeholders

How did we land in 2019 and the take-off of MPD SME CAPITAL

Discover the MPD world, network, and accomplishments through our press release.

How did we land in 2019 and the take-off of MPD SME CAPITAL

Geneva, Switzerland – On August 30th MPD SME Capital One has officially finalized the acquisition of a majority stake in La Centrale de Prévoyance (LCP), a Swiss insurance regulated agency.

Syracuse, NY – On July 29, MPD Partners officially launched a strategic collaboration with the Blackstone LaunchPad powered by Techstars at Syracuse University’s Libraries, the campus central innovation hub.

NY State Governor Cuomo announces that MPD Partners’ client Sentient Blue wins GENIUS New York, the World’s Largest UAS Business Competition.

On the 14th December 2018, MPD Partners’ client Sentient Blue, Italian start-up operating in the UAV (drones) sector, has received the investment confirmation from the Genius New York Accelerator Program. Genius NY is the world’s largest Unmanned Aircraft System competition, part of the investment plan backed by New York State Governor Andrew M. Cuomo for the development of the UAS industry in Central NY area.

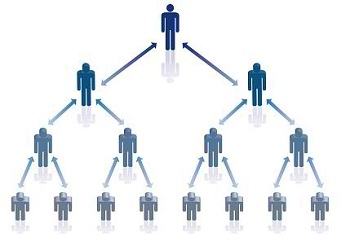

MLM and a Pyramid schemes have a similar structure, but they are based on different commission plans and concepts of selling, that results in legitimacy and illicitness, respectively of their business models. We examine 5 successful MLM Companies and summarize their strategies to understand what makes them successful and how they use network marketing to sustain business. Subsequently, we establish certain principal requirements for MLM business model to be successful in the long run.

Digital Mill recently closed its official financials and the results prove the ability of MPD to manage SME businesses to improve their management processes with an impact on company value to all stakeholders. “The numbers fully support what we retained from the market: the value of Digital Mill has been increased thanks to a market positioning plan, new clients, operational excellence and an improved financial stability. This is what we are supposed to do and we are glad to achieve results that are core in the SME Private Equity business” says Mirco Coccoli, current CEO of Digital Mill.

On the 8th June 2017 MPD Partners hosted a seminar event in its Italian Branch “How and why Italian SMEs attract funds since 2016?”. In a collegial environment, the seminar discussed recent trends in the Italian Private Equity market and the recent increase of Italian SMEs attractiveness for investment funds.

MPD Partners is pleased to announce that on the 21st if April 2017 Mirco Coccoli, founding partner of the company, has been appointed in Digital Mill S.r.l. Board as Member of Board of Director.

MPD Partners analysed the US solar industry and identified appealing trend combining construction and clean-tech features.

MPD Partners analysed the Italian olive oil industry to select a target company suitable for an acquisition. This analysis allowed MPD Partners to get in touch with 27 olive oil companies with revenues between EUR 10M and 140.

This investment case captures the opportunity to consolidate the pharmaceutical retail sector. The opportunity is created by an on-going legislation process which will liberalise the pharmacy business in Italy.

MPD Partners was invited to the Italian Embassy in London this week to attend a key event, “Sardinia Goes Global”, for Italian SMEs. On behalf of/Representing MPD, senior associate Andrea Gasparini attended the event, which was led and organised by London-based start-up incubator iStarter alongside Clhub, a firm supporting the launch of newly created companies from Sardinia. Two very appealing projects were presented: Moneyfarm, an online investment advisory company that recently raised €16m, and Veranu, an alternative energy producer whose technology enables the production of clean electricity from various, innovative sources. MPD Partners is always proud to support Italian SMEs, and wishes to congratulate all the participants for their achievements.

Marble industry: on the occasion of Marmomacc 2016 we analysed the main drivers of the sector and the risk-performance profiles of SMEs operating in the extraction and processing businesses.

From SMEs to Innovation: this month we looked at several value drivers at this critical economic juncture, and found out that with innovation come benefits and risks.

At MPD, we measured the risk of a sample of Italian SMEs using ten critical metrics. The research concludes that some of the firms are balancing on the wire.

Mirco Coccoli interview at Dukascopy TV.

This document aims at descibing MPD procedures regarding risk management. Here you find only the table of content because of confidentiality reasons.

The tension between Italian banking system and SMEs is not going to subside soon. However it could bring opportunities to financial institutions.

With the banking system still in flux, small and medium enterprises (SMEs) find themselves between a rock and a hard place.

MPD´s ambition is to create and enhance a high yielding real estate portfolio following a “Buy-to-let” investment strategy, sourcing real estate investments with a manageable risk profile and with above market average return on asset. The primary focus will be on the sub-asset class “Student Accommodation” in the UK.

This investment case captures the opportunity to invest in the end-user distribution of Electric Energy & Gas.

This document describe MPD Venture Portfolio main features and the selection methodology.

This document provides examples of how MPD practically approaches the pre-due diligence process. In particular we provide the case of a company operating in the paper business and the case of a company operating in the technical rail business.

MPD PARTNERS – – Privacy & Cookie Policy

Terms and conditions outlined in the websites represents examples and basic explanations, but are not contractual. All business relations and investments are based on contracts and offering memorandum discussed and signed on a case by case basis.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.